Zakah is one of the fundamental pillars of Islam which is also known as al-sadaqa al-wajiba (obligatory almsgiving). According to the Shariah, someone who qualifies for the nisab must spend a specific amount of his or her wealth upon those who are eligible to receive Zakah so that their poverty is alleviated. Following is an excerpt from the book Zakah and Charity written by Shaykh ul Islam Dr. Tahir ul Qadri

Q. What are the linguistic and legal meanings of zakah?

A: Linguistically speaking, the word zakah bears two meanings: the first meaning is purity, and the second is growth.[Ibn Manzur, Lisan al-Arab, 14:358.]

The first meaning of zakah, which means purity, can be understood from the following verses of the Quran:

Indeed, the one who purifies his (ill-commanding) self (from all vain and vicious desires and cultivate in its virtues and piousness) succeeds, but the one who corrupts himself (in sins and suppresses virtue) is doomed indeed.

The concept of success which is given by these verses through the purification of the inner-self, gives zakah the meaning of purifying wealth from all impurities by spending in the way of Allah. The second meaning of zakah is growth. Keeping this meaning in mind, zakah refers to wealth that does not decrease when spent in the path of Allah but grows by Allah’s blessing.

Q. What are the conditions for the obligation of zakah?

A: The following conditions must be fulfilled in order for zakah to be obligatory upon an individual:

1. Being a Muslim: zakah is not obligatory on non-Muslims.

2. Maturity: zakah is not obligatory upon children.

3. Sanity: zakah is not obligatory on those who are mentally handicapped.

4. Being free: zakah is not obligatory on prisoners.

5. To be in complete ownership of wealth: the wealth can only be subject to zakah if it is in complete ownership of the individual. For example, if someone buried his possessions somewhere and forgot where he buried it, but years later he regained his lost possession, then he will not have to pay zakah during the interim period when the possession was missing.

6. The wealth should be surplus of one’s basic necessities.

7. To be free of debt: if someone has £1000 in saving, but also has a debt to pay of £1000, that person is not free from debt thus he is not required to pay the zakah.

8. Zakah is payable on that wealth and property which grows, either tangibly such as trade stocks or grazing animals, or in value such as gold and silver.

9. The total value of the wealth and property must be above the payable threshold (nisab) as determined by the Shariah.

10. The person must be in possession of that wealth, which is above the ni|¥b value, for a complete lunar year. That is, zakah does not become obligatory simply by possessing wealth in excess of the nisab, one must also be above the nisab value after a whole lunar year has passed.

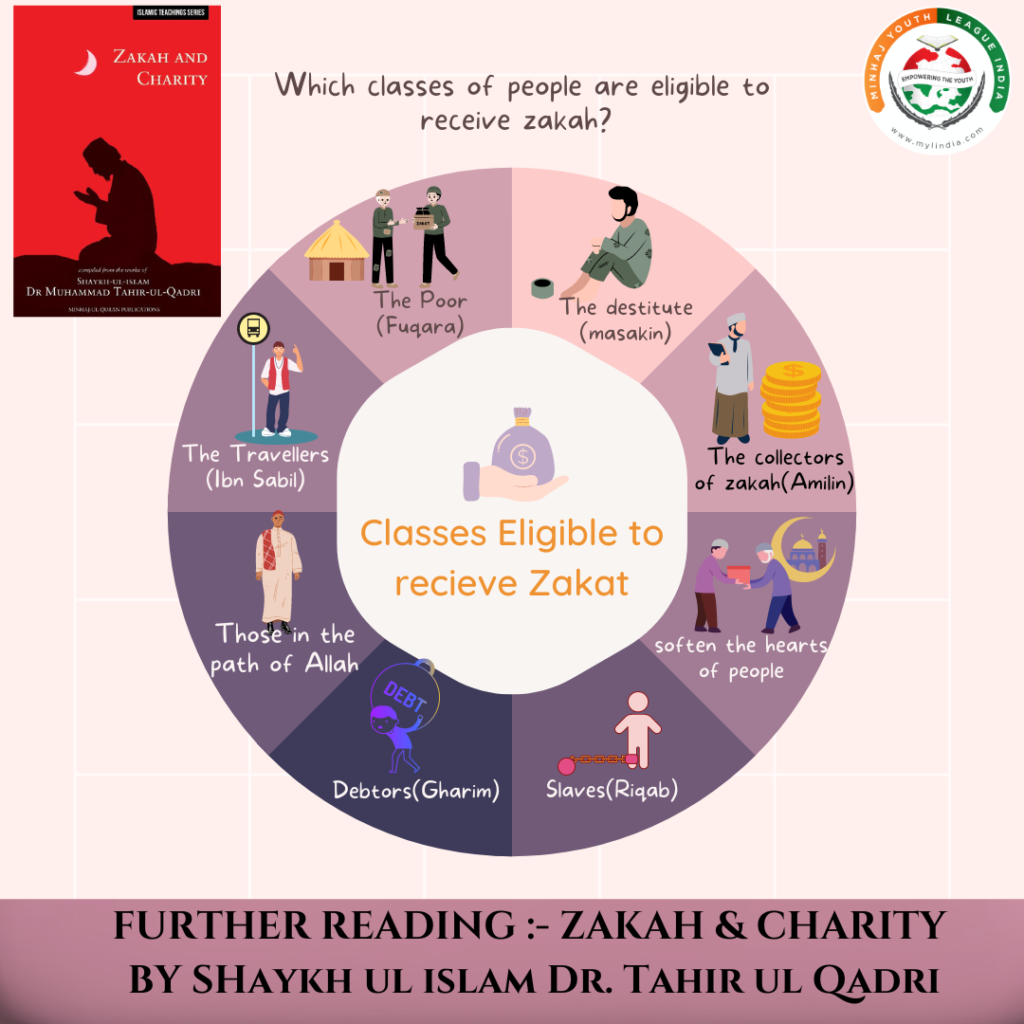

Q: Which classes of people are eligible to receive zakah?

A: According to the Quran, there are eight categories that are eligible to receive zakah. In light of the Quranic verses, the following eight are the categories of zakah:

1. The poor (fuqara)

2. The destitute (masakan)

3. The collectors of zakah (Amilin)

4. To soften the hearts of people (mu’allafa al-qulub)

5. The slaves (riqab)

6. The debtors (gharimin)

7. Those in the path of Allah (fÏ sabil Allah)

8. The travellers (ibn sabil)

Q: What is a faqir?

A: According to the jurists, a faqir is such a person who has some belonging through which his basic needs can be met, but it amounts to below the threshold level (nisab). This is the first category of those eligible to receive zakah.

Q:What is a miskin?

A: A miskin is poorer than a faqÏr and is thus needier. This is the second category of zakah. A miskÏn like a faqir is also dependant on others.

Q:Who are the amilin?

A: The Amilin are those people who are appointed by the government to collect zakah and ¢ushr (the tax on crops). They will be paid a salary from the zakah fund irrespective if they are rich or poor.

Q:What is meant by Muallaf ul -Qulub?

A: This is the fourth category eligible to recieve zakah. The purpose of this is to financially assist those who are fiercely opposed to Islam in order that their opposition to Islam can be extinguished. This also includes those selected non-Muslims who can be brought closer to Islam by being supported financially in order that they embrace Islam. This also includes the financial support of those who have newly converted to Islam so that their financial difficulty does not force them to revert back to disbelief. We can find numerous examples of this in the life of the Holy Prophet(peace be upon him) where he would give financial assistance to various tribes and families to soften their hearts towards Islam.

Q:What is a riqab?

A: Riqab literally means necks and is used in the meaning to free slaves. This is the fifth category of those eligible to receive zakah. Before Islam, the institution of slavery was prevalent in most of the world. Weak, needy, and poor people were enslaved by powerful people. Similarly, as a result of

wars, the dominant party would enslave the defeated people and take ownership of their homes, land, and even their lives. Islam took a gradual approach to bring an end to slavery: it created legal and moral avenues for setting

slaves free. The Muslims were encouraged to use their wealth to invite slave owners, who were unwilling to let go of their slaves for free, to forgo their ownership. Islam also gave a slave the right to earn his freedom; this is

known as badl al-kitaba. The slave would be freed on the payment of the desired amount which could be paid using one’s zakah money.

Q:What is Gharim?

A: This is the sixth category of those eligible to receive zakah. Gharim refers to someone who is in debt. Zakah money can be used to pay off debt.

Hadrat Anas b. Malik(RA) narrates that the Holy Prophet(peace be upon him) said: “It is not permitted for anyone to beg except in three situations: a destitute who is in dire poverty; a person heavily in debt; and the one who has to pay blood money.[Narrated by Ahmad b. Hanbal in al-Musnad, 3:126 §12,300; Abu Dawud in al-Sunan, 2:120 §1641; Ibn Majah in al-Sunan, 2:740 §2198]

Further Reading : Zakah & Charity by Shaykh ul Islam Dr. Tahir ul Qadri